Formidable What Are The Issues When Accounting For Impairments

If there is a change in an intangible assets estimated useful life the change is treated.

What are the issues when accounting for impairments. A new major component that is added to an existing asset. CPAs should test for impairment when certain changes occur including a significant decrease in the market price of a long-lived asset a change in how the company uses an asset or changes in the business climate that could. Question 4 UST Industries has set up a single account for all intangible assets.

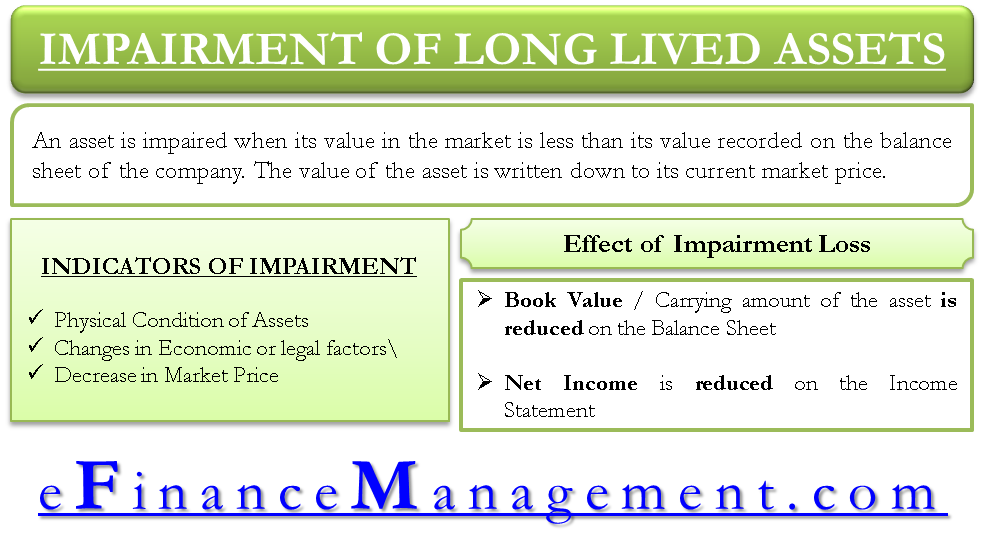

How the impairment ie the amount by which fair value is less than amortized cost is recorded depends on what factors are causing the impairment. An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value. To provide accountants with a comprehensive knowledge of accounting principles concerning impairments of assets intangibles capitalization and goodwill.

IMPAIRMENT EXISTS WHEN THE CARRYING AMOUNT of a long-lived asset or asset group exceeds its fair value and is nonrecoverable. The following summary discloses the debit entries that have been recorded during 2020. Current Issues Impacting Impairment Testing.

The asset is more than 50 likely to be sold or otherwise disposed of. IMGCAP 1Because of challenging economic times and confusion in the audit review process impairment testing has become a hot topic. Any amount of impairment resulting from credit losses is recorded as an allowance for credit losses with the offset in the income statement.

When to recognize the impairment. What are the issues when accounting for impairments. Physical damage to the asset a permanent reduction in market value legal issues against the asset and early asset disposal.

A journal entry to record the amortization of an intangible asset would include a. The chapter on impairment of assets covers impairment of inventories impairment of assets other than inventories reversal of an impairment loss and disclosures. There are historical and projected operating or cash flow losses associated with the asset.

:max_bytes(150000):strip_icc()/accountingcalculating-5bfc31ba46e0fb00517d103f.jpg)